The Basics

Used to identify support, resistance, trend and momentum with multiple components. Very visual.

Indicator Type

Trend finder

Markets

All cash and futures, not options

Works Best

All markets and time frames.

Formula

There are five components:

- Tenkan Sen (Conversion Line) - Calculated as the sum of the highest high over the past nine periods and the lowest low divided by two

- The Kijun Sen (Base Line) - Calculated as the sum of the highest high over the past 22 periods and the lowest low divided by two.

- Senkou Span A (leading) - The sum of the Tenkan Sen and the Kijun Sen divided by two. The calculation is then plotted 26 time periods ahead of the current price action.

- Senkou Span B (leading) - The sum of the highest high and the lowest low over the past 52 periods divided by two. It is also plotted 26 periods ahead.

- Chikou (lagging)) – The same and Senkou Span B leading but plotted 26 periods in the past.

Parameters

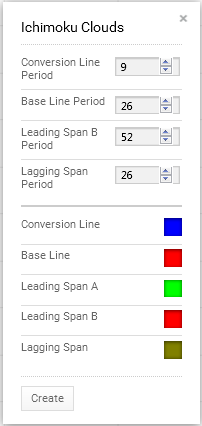

Parameters were fixed in the original version of the study but can be adapted to trader preference and are shown in the illustration here.

Parameters were fixed in the original version of the study but can be adapted to trader preference and are shown in the illustration here.

As may be obvious, the 52 parameter is the number of weeks in a year with 26 being a half cycle The 9 parameter is a common number used in many other studies when the user wants a slightly more sensitive reading compared to the more common 14.

Theory

The area between the two Sekou span lines forms the cloud. It is a thicker version of normal support and resistance lines and it takes volatility into account. A break through the cloud and a subsequent move above or below it will suggest continued trending in that direction.

Interpretation

As with many other complex theories and indicators, traders tend to use the simplest to understand portion. This write-up only addresses the cloud portion although there are indications of trend strength and momentum in the analysis of the other components.

The overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. In an uptrend, a green cloud indicates more strength. In a down trend, a red cloud indicates more weakness.

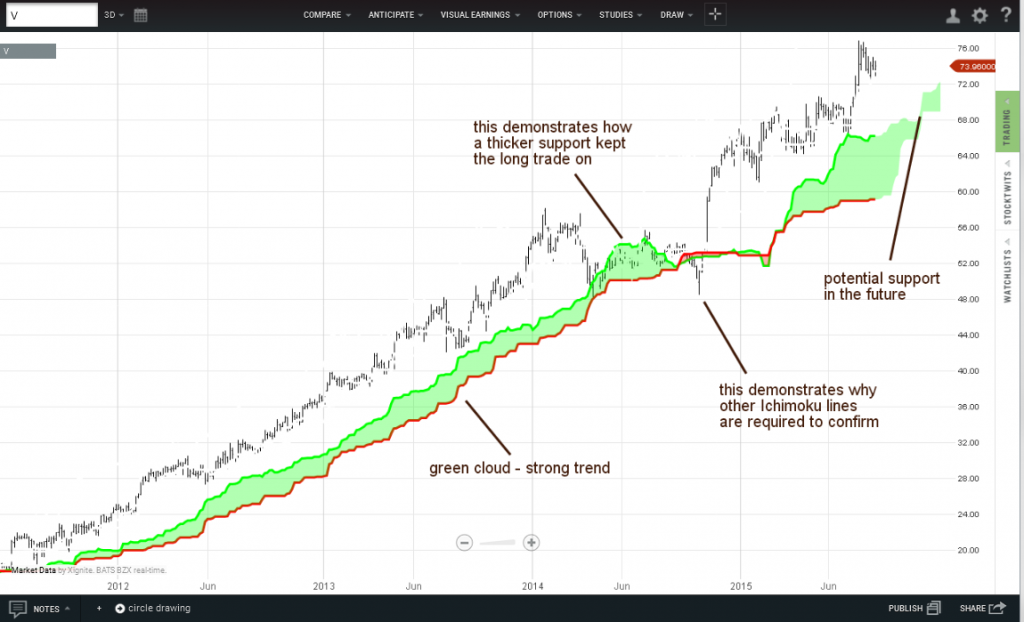

Because the cloud is shifted forward 26 periods, it also gives an indication of support and resistance in the future.

Here are some rules of thumb. This write-up did not discuss how to use the conversion and base lines and will be updates in the future to include them.

Bullish Signals:

- Price moves above Cloud (trend)

- Cloud turns from red to green (strength)

Bearish Signals:

- Price moves below Cloud (trend)

- Cloud turns from green to red (strength)

Visa was in a strong trend and the greed cloud confirmed its strength. It acted as support until mid-2014 when prices dipped into the cloud. While selling was not indicated, caution was and the stock did nothing for weeks.

A false breakdown in September did not lead to a new declining trend but just using the cloud did not pick that up properly. That is why the other elements of the Ichimoku study are needed.

Regardless, when the stock jumped back through the cloud the bulls were back and the cloud itself was once again support.

But again, this is just to demonstrate the portion of the study most novices use. It will be updated to cover all components at a later date.

Math

coming soon